I personally do not invest in Mutual Funds except for ELSS (where we get instant return in form of tax incentives) and Liquid & Low Duration Debt Funds for Asset Allocation and to park temporary cash. While it is not a bad idea for a know-nothing investor to put his/her savings in a diversified mutual fund and reap the baseline drift compounded over many years, I find many flaws with mutual fund investing (listed below). I believe with little effort on weekends and long term view coupled with technical analysis, one can easily beat most mutual funds. I think someone investing in Index stocks barring PSUs will be ahead of most of the funds.

High Charges

Charge of Mutual Funds for Management Fee & Operational Expenses (called as Total Expense Ratio) is very high (1.5-2% annually). TER is a percentage of the market value of the corpus which is deducted from NAV on daily basis. In the case of stocks, you need to pay fixed annual maintenance charges and one-time transaction charges (delivery based buying is free with discount stock brokers), which work out to be a tiny percentage amount.

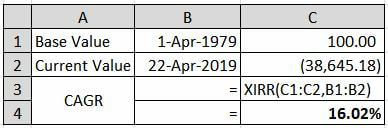

Now before you argue about direct plans and call me penny-pincher, let’s do the math. Suppose someone starts a monthly SIP of ₹5,000 at the age of 20 years for his retirement, and if expected return CAGR is 15%, he will be able to accumulate ₹15.5 Crores at the end of 40th year. Let’s say, investor invested in a direct plan where TER was just 1%. If we deduct 1% as TER from the CAGR, then @14%, the corpus will grow to ₹11.2 Crores when he attains the age of 60 years which is ₹4.3 Crores less. Cost & Return in MF is not in your favor. High cost drags down the return and negatively affects compounding.

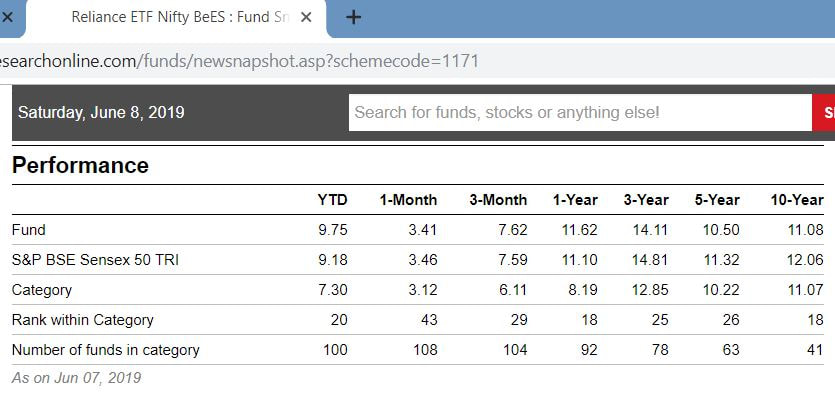

Falling Alpha

When you pay 1-2% in fees, you would expect the fund to earn a compounded annual return which is over FD and beat its underlying index. Sadly, as we are witnessing, majority of the funds are unable to beat their underlying index, let alone generate Alpha. Quant funds, Smart beta funds, Dynamic funds, Hybrid Aggressive funds, Balanced Hybrid funds, Tactical Asset Allocation, Dynamic Asset Allocation; they have tried all but results have not been impressive. Irony is TER is deducted even when fund is yielding negative return.

Over-diversification dilutes returns

There is a consensus among astute investors that all the benefit of diversification and risk reduction in a portfolio is achieved with 15-20 stocks; anything beyond that only leads to mediocre. However, except Focused funds, most oher funds are found to own 50-60 stock portfolio. An investor holding 5/6/7 different funds in his portfolio, ends up holding over 250-300 stocks. Even if he de-duplicate the holdings through proper analysis, they would realize they pretty much own whatever of the market there is to own, resulting in dilution of returns. You can't beat the market if you buy the market.

Conflict of Interest

The job of a fund manager is to beat the benchmark and he hardly tries to generate 25-40% kind of superior return. Say, in a year when the benchmark was down 20% and fund was down just 10%, it will be termed as outperformer while investors are sitting at a notional loss of 10% on their capital. Since all is to be done is to beat the index by small margin, they closely align their portfolio with underlying benchmark and avoid any undue risk by betting on any high conviction idea. No wonder, you will always find HDFC, L&T, TCS etc. in most categories of the funds. I do not wish to see HDFC Bank under Top10 holdings of a Midcap fund (as in case of DSP Midcap & Axis Midcap funds).

Ethical Issues

Like other financial products, mis-selling is rampant in MF industry too. Selling equity midcap fund showing past returns to senior citizens, selling equity funds with dividend options promising regular income while hiding the facts about DTT, presenting only the regular plan and hiding direct plans are few common mis-sellings I have personally witnessed at CAMS offices. Expert guidance in many MFs is a myth. Many funds are found to be stocking with non-performers or stocks of unethical companies for long (Eg. Motilal Oswal holding Manpasand Beverages even after it’s GST evasion) and not liquidating even when wisdom dictates so. Many fund managers are not reading the Balance Sheet closely and rely on news.

On several occasions, mutual fund have been found not only putting the interests of own business above the interests of retail investors but also breaking the moral code of conduct. As per a moneylife report, last year (in Mar-18), 56 MF Schemes Bailed Out Failing ICICI Securities’ IPO in March and Many Sold All the Shares by June at a Loss, all this at the cost of investors. Last month (May-19), 7 DSP IM officials had provided funds to an ex-employee who in turn traded in securities market.

In many instances, fund managers are found not sticking to their investment philosophy. For example, a value fund taking momentum calls. While it is acceptable for funds with Special Situation or Contrarian Investing style to have a high churn (or turnover ratio) but a fund house following a ‘Buy Right, Sit Tight’ or ‘Buy and Hold ‘strategy cannot afford to have a turnover rate of above 50%.

Constrained Environment

Mutual Funds being structured for a wide mass of retail investors tend to be regulated strictly. Recently, SEBI declared guidelines for Mutual Funds to categorize their schemes; large cap have been defined as top 100 stocks by market cap rank, midcaps have been defined as 101-250 by market cap rank and the rest as small cap. This means that most of the MF industry equity exposure will be relegated to top 250 stocks. This leaves little space for stock picking and generating alpha. There is hardly any prevalence of small cap funds in the mutual fund industry and small cap mutual funds by definition have scalability challenges once they cross a certain size. For this very reason, DSP & L&T fund houses stopped fresh inflows into their midcap plans.

As per SEBI norms, no stock can be over 10% of portfolio exposure. So if a stock due to its superior performance appreciates to become 12% of the portfolio or say a stock classified as mid cap appreciates over time and comes within the large cap basket which doesn’t fit for the investment universe of the fund, fund manager is forced to sell it to bring the exposure to 10% limit.

As MF size grows huge, it cannot simply stop buying low performing companies given the limited opportunities and 10% cash holding cap. You can stop buying further and reduce exposure to Equity when market has become expensive. This is the euphoria time when more and more money flows to MFs and SIPs continue. As a fund manager cannot sit on cash beyond 10% limit, so is forced to buy at high valuations. Fund own Size, less space for taking cash calls, shortage of opportunities to utilize fresh funds, script-level exposure restriction etc. all result in average return of the fund.

You pay for other’s mistakes

Mutual Funds being managed and held as a pool may be at times exposed to vagaries of the sum total behavior of hundreds of thousands of investors. In general, investors tend to invest in rising markets or improving fund performance and there could be times of panic in rapidly falling markets and times of poor fund performance. It may happen that mutual funds at times are forced to buy in rising markets and sell in falling markets because fund managers have discretion on stock picks but not on fund flows. Redemption pressure results in falling NAV of the fund.

You are in a lurch if Fund Manager Changes

Investing in a mutual fund is basically betting on Fund Manager’s capability. Thanks to the bull market, a lot of fund managers have moved across fund houses and a few of them have even moved out and opened their own investment firms. Few examples: Kenneth Andrade (from IDFC to his own venture Oldbridge Capital), Vetri Subramaniam (from Invesco to UTI), Manish Gunwani (from ICICI Prudential to Reliance), Gopal Agrawal (from Mirae Asset to Tata MF and now has quit TATA MF as well) and most recent exit of Goutam Sinha Roy (from Motilal Oswal) which has put redemption pressure on already underperforming Multicap 35 fund.

For most of the funds where the fund manager has changed, the existing track record becomes irrelevant while choosing the fund. The fund houses will (obviously) argue that they have a robust investment process and a change in the fund manager will not have an impact, but I think it would be extremely naive of us to believe that. A fund manager is the biggest factor responsible for the returns from a fund. (Think Warren Buffet, Charlie Munger, Ray Dalio, Howard Marks, Seth Klarman, Peter Lynch etc.).

MF is as painful as Direct Equity

Choosing good MF is as challenging as selecting good stock (go through above point again). An equity mutual fund is more or less as volatile as stock. Both require similar emotional maturity for entry, exit or stay put decisions.

RSS Feed

RSS Feed